Free VITA Tax Preparation Services –

PBICVR & United Way Partnership

Get Your Taxes Done for FREE!

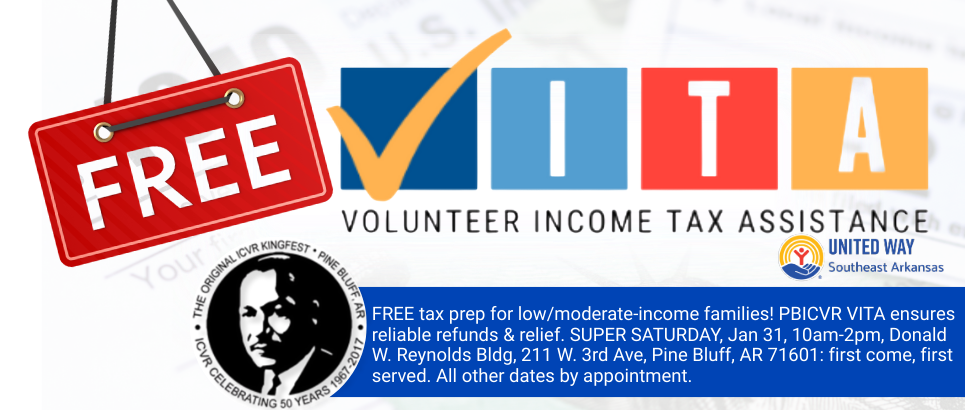

PBICVR, a proud United Way Southeast Arkansas agency, is once again offering free tax preparation through the VITA (Volunteer Income Tax Assistance) program for households earning $64,000 or less per year. Our IRS-certified volunteers are here to help you file your taxes safely, accurately, and at no cost—making sure you get every credit and deduction you deserve.

When to Come In

- Tax Season Kickoff: For the 2026 tax season, you can start filing your 2025 taxes on Saturday, January 31st, 2026 during our "SUPER SATURDAY" first come first serv ved at the Donald W. Reynolds Building. (the precise IRS opening date will be announced soon).

- Filing Deadline: The deadline to file your 2025 federal tax return is April 15, 2026—but don’t wait until the last minute!

- Appointments Required: Past "SUPER SATURADAY" All VITA sites operated by PBICVR and partners are by appointment only to ensure efficient, high-quality service.

SUPER Saturday – January 31st: First Come, First Served!

Mark your calendar for SUPER Saturday, January 31st!

To kick off tax season, PBICVR and United Way are hosting a special walk-in event:

- No appointment needed—first come, first served!

- Where: 211 West 3rd. Ave. Pine B,luff, AR 71601

- When: Saturday, January 31st, 10am - 2pm

- Who’s Eligible: Households earning $64,000 or less per year

- What to Bring: Social Security cards, photo ID, W-2s/1099s, and any tax documents

Let our friendly, trained volunteers prepare your taxes for free and help you claim valuable credits like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC). Save money, maximize your refund, and avoid costly fees!

Why Choose VITA with PBICVR & United Way?

- Completely Free: No hidden fees—just expert help.

- Trusted & Secure: All volunteers are IRS-certified for your peace of mind.

- Bigger Refunds: We help you claim all credits and deductions you deserve.

- Financial Empowerment: Keep more of your money, pay bills, build savings, and avoid predatory tax prep services.

- Community Impact: Every year, VITA services return thousands of dollars to local families—strengthening our community and economy.

How to Get Started

- Book your appointment: Register below or call PBICVR- 870-730-1131 / United Way SEARK- 870-534-2153

- SUPER Saturday Walk-In: Just show up at our site on January 31st—no appointment needed for this special day!

- Questions? Contact PBICVR at 870-730-1131 for details about required documents or eligibility.

Don’t miss this chance for free, confidential tax help!

Join us on SUPER Saturday, January 31st, or schedule your appointment today—let PBICVR, United Way, and our partners help you get the refund you deserve!

PBICVR’s VITA program is made possible through partnerships with United Way, local nonprofits, financial institutions, and dedicated community volunteers. Together, we’re building financial stability for Southeast Arkansas—one tax return at a time.